Two decades before Bitcoin and Crypto, I launched the first global digital currency of the web: The Beenz.com story.

Beenz—was on the path to become a multi-billion dollar giant. Here is the untold story. Lessons for today’s start-up founders and crypto investors.

The Beenz Journey: Creating the Web’s First Digital Currency

Heard of Bitcoin? Ethereum? Tether? Beenz? Probably not the last one—but that’s about to change. Long before blockchain and cryptocurrency reshaped finance, I was part of the pioneering team that launched Beenz.com—the first web-native digital currency.

This is the true story of Beenz, told from the perspective of one of its key protagonists—the creator of its most valuable asset: its global brand.

The concept of Beenz as a purely digital, internet-native currency was groundbreaking. We were envisioning a financial future beyond traditional banking, including digital micro-payments, laying the groundwork for what would later become fintech and crypto.

While Beenz ultimately became a high-profile casualty of the 1990s dot-com crash (despite raising nearly $100 million), it played a crucial role in shaping some of the ideas, technologies, and applications that foreshadowed the future of digital currencies.

But this is more than just a story of innovation; it’s also a story of hard-earned lessons—what we got right, what we got wrong, and why failure can be the ultimate training ground for large-scale disruption and reinvention.

Joining Beenz.com and Building the Web’s Currency Brand

1998 was a pivotal year in tech, marked by the founding of Google and PayPal. The same year, I was approached to join Beenz as both an investor and Chief Marketing Officer, bringing my global brand-building expertise to the project.

At the time, I was leading my own international branding agency, where I developed major brands and strategies for companies such as Santander, Coca-Cola, and British Airways. I was also working with the European Union on European identity projects and the forthcoming launch of the Euro—a landmark global event. The new Euro currency was set to debut digitally on 1 January 1999, followed by the historic introduction of 52 billion coins and 15 billion banknotes across 12 EU countries on 1 January 2002, marking the largest cash changeover in history. The world of global currencies was on the brink of disruption. The future symbol of the Euro (€) had been created in 1996 and was based on the Greek letter epsilon (Є).

From a Loyalty Points System to ‘The Web’s Currency’

When I first discussed the concept of Beenz at our offices in Mayfair, London, it was initially framed by its founder as an internet reward scheme for the web, where consumers earned Beenz points for activities like registering on websites or making online purchases. However, my work on the Euro currency made me realise its potential to be something far greater—a global digital currency rather than just another points-based ‘permission marketing’ concept. By leveraging the media buzz surrounding the Euro’s launch, we could position Beenz as the world’s first true digital currency—beating the EU to market by two years. This would allow us to generate significant marketing buzz.

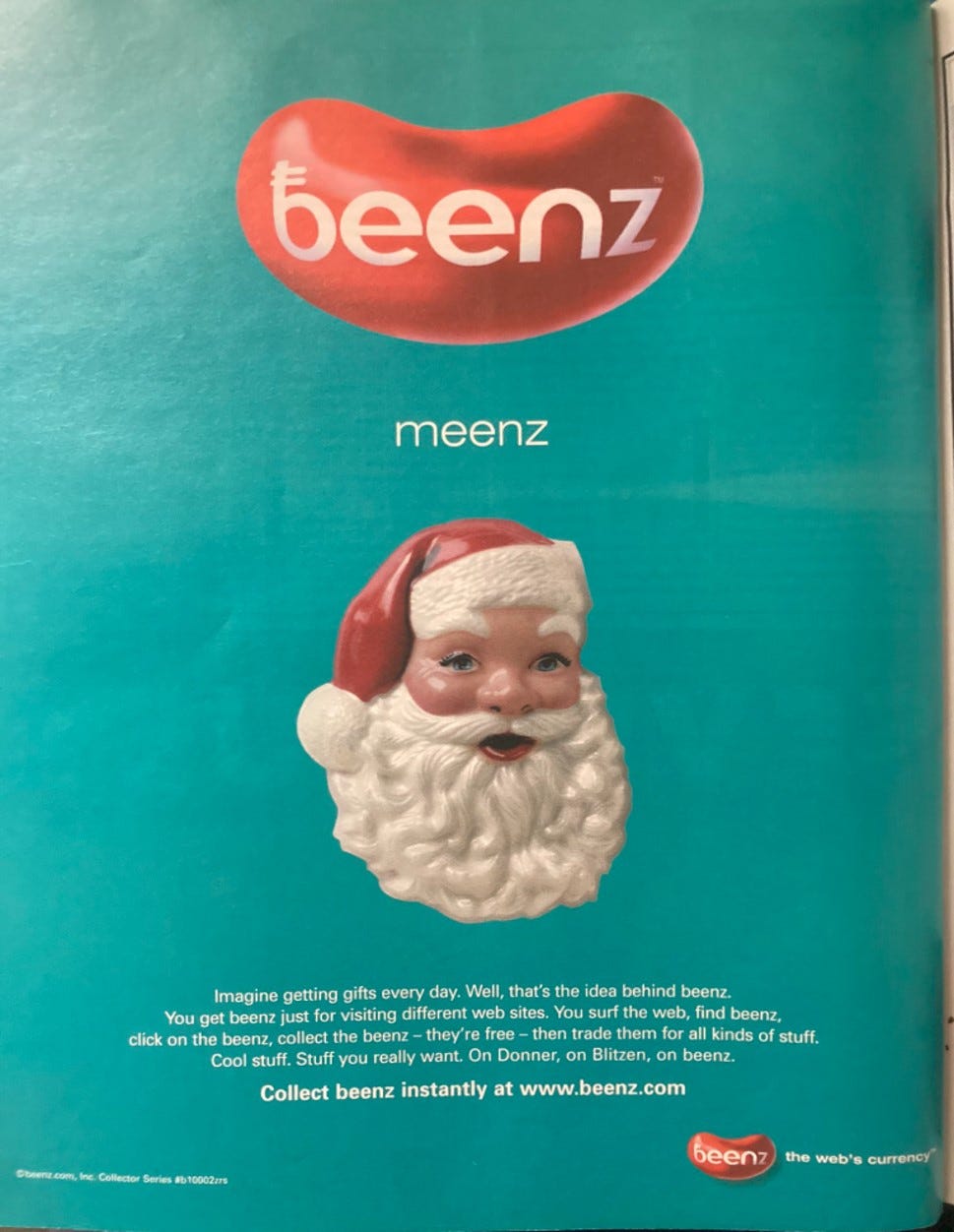

The name "Beenz" was originally conceived by its founder as a playful reference to rewarding users for having "been" to a site, with the added ‘z’ giving it a trendier, more distinctive edge.

The Brand Vision: A Universal Digital Currency:

Beenz, The Web’s Currency is born.

My brand vision was to position Beenz as a universally accepted currency for the web—one that allowed people to exchange value seamlessly across borders and on any device.

To bring this vision to life, Beenz needed a bold and distinctive brand identity—one that would establish it as a credible digital currency. As CEO and Creative Director of Megavisionary Labs (formerly Twelve Stars, named after the European flag), I led my London design team to think beyond convention, exploring the ‘future world of money’ and crafting a radically new visual identity that would give Beenz the legitimacy of a true, futuristic global currency.

We studied the history of money, currencies and their symbols, understanding that visual legitimacy is key in financial systems. To align Beenz with global monetary standards, we explored various iconic shapes and motifs before designing the now-famous Beenz logo. The ‘b’ of Beenz, featured two crossing lines, symbolically linking it to the famous currency symbols like the Pound (£) US Dollar ($), Japanese Yen (¥), Chinese Yuan (¥) and the upcoming Euro (€) .

This carefully crafted ‘b’ emblem symbolised its role in the emerging digital economy and became a cornerstone of the brand, reinforcing Beenz’s credibility and its position as a legitimate digital currency. This brand vision culminated in our powerful tagline: "Beenz—The Web’s Currency."

Disrupting the Market with Bold Tactics: Guerrilla Marketing

To break through the oversaturated advertising market, we had to be disruptive. I chose a guerrilla marketing strategy, crafted in collaboration with our London PR agency, to generate massive global attention. For our London launch, we covered nearly every available black cab in the city with the Beenz brand. We secured so many taxis that spotting one was inevitable. To maximise visibility among business leaders, we even instructed drivers to focus their routes around the City of London financial district, ensuring potential investors couldn’t miss them.

The same week, we plastered Beenz stickers on every bank ATM overnight, creating an intriguing message: a new kind of money had arrived. We created "The Beenz Army"—groups of young people in Beenz-shaped costumes handing out lollipops and stickers. Our boldest move? Renting an armored bank vehicle, painting it with Beenz branding, and driving it through London, culminating in a photo-shoot in front of the Bank of England. Yes, the actual Bank of England!

This unconventional ‘guerilla’ marketing created a media frenzy, with Beenz gracing newspaper and magazine covers. We replicated these tactics in every new city we launched, generating excitement and solidifying Beenz as a disruptive startup.

By 1999, The Wall Street Journal proclaimed, “The global monetary system of the next millennium may amount to a hill of Beenz. Behind the scenes, Beenz works as a sort of central bank.”

We were building something truly unique: a new, borderless world currency.

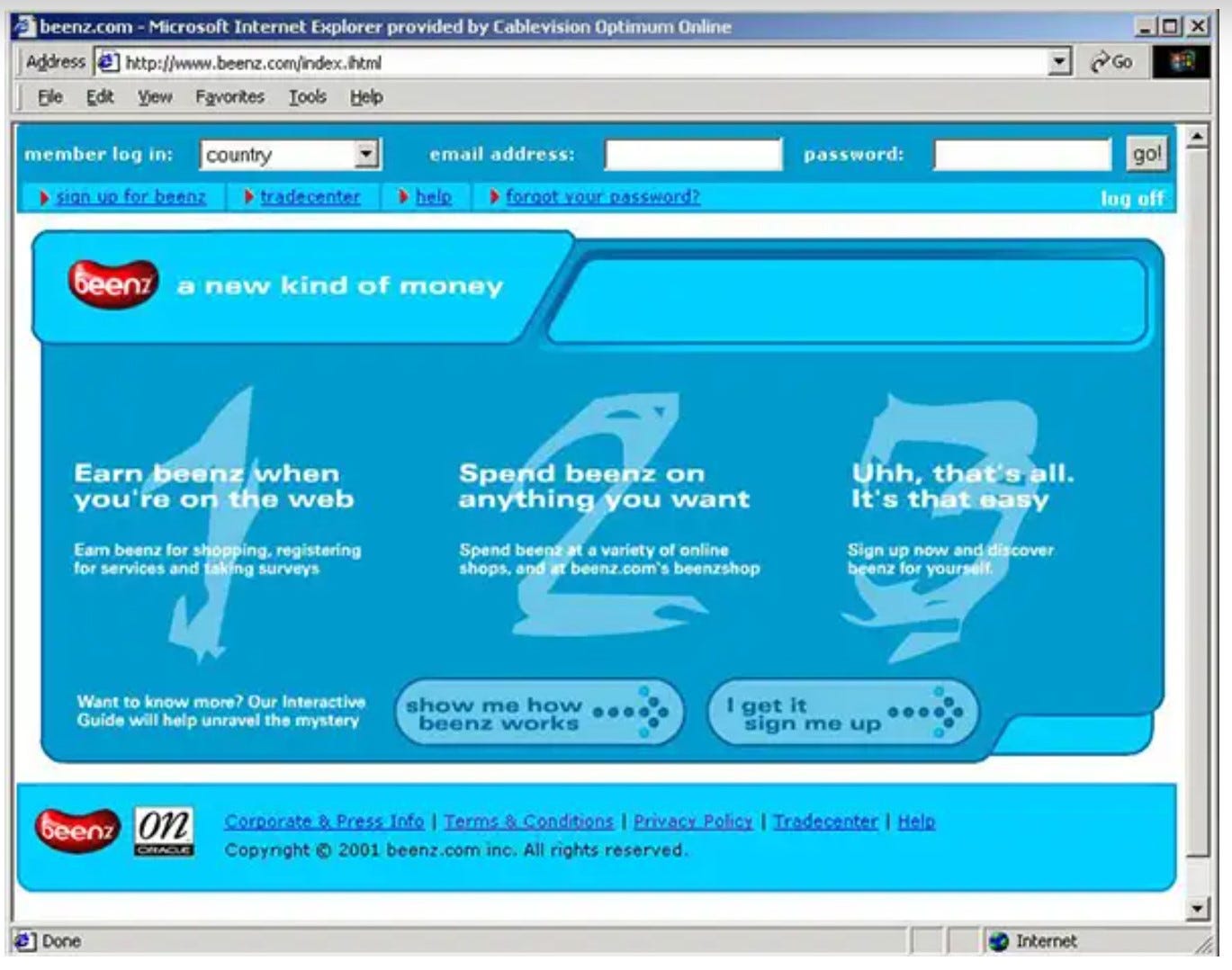

How Beenz Worked: A Digital and Fungible 'Attention' Currency to Earn, Spend, and Trade

More than just a currency, Beenz incentivized digital behavior, becoming the first to directly pay people for their time in the emerging "attention economy," where consumers could opt-in to receive promotional messages and businesses could pay for engagement. One of the defining features of Beenz was its fungibility—each unit was identical and interchangeable. Unlike airline miles or existing closed-loop loyalty points, Beenz had real transactional value that could be used across multiple vendors and platforms. This concept is foundational to modern cryptocurrencies: the idea that digital assets must be interchangeable, easily transferable, and widely accepted to function effectively as money. Users earned Beenz by engaging with online content—visiting websites, completing surveys, or making purchases. Opening a Beenz account was free, with an initial 500 Beenz credited to new users. They could accumulate more Beenz and then spend or trade them. The Beenz Counter, a downloadable tool, provided real-time account monitoring.

Gathering a Powerhouse of Global Investors

The global brand launch of Beenz had already reached multiple countries and set the stage for our ambitious vision. Our message to investors was clear: “Get on the bandwagon or be left behind.” Before March 1999, we raised an initial $2.5 million from our network of contacts—through the "angels and family and friends" round. But we knew our growth couldn’t stop there. To expand our reach and solidify our presence, conquering America was a critical part of our strategic plan.

We opened offices in New York's iconic Wall Street skyscrapers (hello Gordon Gekko!)—after all, we were a financial product—and followed up by establishing a base in San Francisco. With this solid foundation, we quickly moved on to raise more funds, beginning with a $2 million round. This was followed by a Series A round, raising $30.5 million, and eventually a Series B round that secured an additional $39.5 million.

This funding momentum not only fueled our rapid expansion but also attracted a powerhouse of global investors who shared our belief in the future of Beenz.

In total, in a period of two years we raised close to $100 million, —a testament not only to the disruptive nature of our vision but also to the power of the Beenz brand and global marketing, which I helped create.

The strength of our brand played a pivotal role in attracting some of the most influential investors of the time. Among them were tech titan Larry Ellison of Oracle, who invested $5 million of his personal wealth, François Pinault of the luxury group Kering, the media giant Vivendi Universal, Italian financier Carlo de Benedetti of Olivetti, Apax Partners, Masayoshi Son of Softbank, and Japanese billionaire Yasumitsu Shigeta, founder of Hikari Tsushin, to name just a few.

Our vision was far more ambitious than that of a typical startup. We were not just creating a new business; we were laying the foundation for the future of the digital economy. This radical approach to digital currency captured the imagination of academia, and in 2000, Harvard Business School recognized our innovation by creating a case study on Beenz.

At that moment, it seemed we were on the cusp of becoming one of the biggest companies in tech history. To make that a reality, we needed to stay steadfast in our belief in the world-transforming potential of our ‘global web currency’ mission. Every step forward required us to remain focused on the brand vision that Beenz was not just a product—it was a revolution in how people would engage with money, technology, and the new digital economy.

The High-Stakes Game of Regulation - Playing by the Rules—Or Rewriting Them

We had to be careful to avoid national and international currency regulations. Our London offices were raided by the police and the UK’s Financial Services Authority after our ‘Bank of Beenz’ stunt.

Launching a new currency or operating like a bank was illegal and could even result in arrest. We engaged with lawyers and finance ministries, ensuring compliance. We had to prove that Beenz could not be transferred directly between consumers and that consumers could not buy Beenz directly.

Authorities often panicked when Beenz entered their markets, preparing to ban us unless we assured them it was a virtual points system, not a currency. To comply with regulations, in some countries I avoided terms like “currency” or “monnaie virtuelle”, as they referred to us in France, in our advertising. In China, government regulations explicitly stated that “foreign currencies shall be banned from circulation in the People’s Republic of China,” and in Hong Kong, which had been officially returned to China in 1997, our advisors warned that using the word ‘currency’ could land me in a Chinese prison for a very long time. Navigating these restrictions was crucial to keeping our operations running smoothly.

Beenz Brand Mania Explodes

We were celebrated as the rock stars of the new digital economy. I was invited as a keynote speaker at every major tech summit in London, Silicon Valley and Silicon Alley—the Manhattan hub of the digital revolution. But it was time to elevate the brand to the next level and send a powerful message. I successfully negotiated an incredible media deal which included a space in one of the world’s most iconic landmark locations—a billboard in Times Square, New York.

We couldn’t afford to enter Formula 1 as a sponsor, but I did the next best thing—I negotiated a contract with Formula 3 driver Gianmaria Bruni, who was being scouted for a potential Formula 1 seat the following season. This deal secured Beenz as a sponsor on a Formula car for TV appearances and photo shoots, with the added advantage that if Bruni advanced to Formula 1, he would be under contract with Beenz. (He eventually made it to Formula 1, though not until 2004.)

To celebrate the success of the Beenz economy, I was tasked to orchestrate a global series of six mega-parties in key markets where we had established offices and Joint Ventures.

In Sydney, we hosted our event at the Stock Exchange. In Hong Kong, we took over the colossal Hong Kong Convention and Exhibition Centre, constructing a gigantic wooden bank safe to symbolise the future of money. The bash attracted 1,000 revellers with celebrities like Jackie Chan, adding to the spectacle. In San Francisco, to make a statement to the Federal Reserve and generate massive PR, I rented the historic United States Mint, while in London, we secured the iconic Lloyd’s Building at the heart of the financial district. This was more than just a launch—it was a bold declaration that Beenz was not just another startup; we were the company revolutionising digital payments.

The Beenz brand had taken on a life of its own, becoming bigger than all of us. We had crafted the dream of a decentralised global currency capable of travelling at the speed of light across geographies and connecting people of all nations. The brand became Beenz’s most valuable asset, and the company rode on its power and immense popularity to attract both investors and new customers.

After these extravagant celebrations, ‘Beenz Brand Mania’ was in full swing. The buzz was so strong that it even inspired a RAP song! One unforgettable lyric captured the excitement:

"Beenz meenz Dinero! Any site could be holding Beenz, I don't have to tell you what it meanz!"

A testament to how deeply the Beenz brand had captured the public’s imagination and become part of popular culture. (And yes, the song is incredibly catchy!) Click below to listen.

Development of offline opportunities to expand reach - The Beenz Master Card.

We developed technologies for Beenz transactions via mobile phones and secured patents that allowed Beenz to expand offline. A defining moment in cementing Beenz as a truly global currency came when we secured a deal to launch the Beenz MasterCard Debit Card. This innovation allowed users to earn and spend Beenz not just online or via mobile devices but also in the offline retail world. By integrating Beenz into everyday financial transactions, we blurred the lines between digital currency and traditional payment systems, bringing our vision of a universally accepted virtual currency one step closer to reality.

Running the Beenz Economy

The Beenz economy was based on an arbitrage system. Partners paid $0.01 to issue Beenz and earned $0.005 back. Consumers could collect Beenz online by clicking on a Java applet and entering their email address, which was linked to their Beenz account. Merchants purchased Beenz and distributed them to consumers for valuable actions. Consumers could collect Beenz and use them to make purchases. Merchants set their own exchange rates and could sell Beenz back to the company. We were running a real economy.

Given the significant money flows, we brought in an economist to ensure the stability of our digital currency system, modeling key economic factors like price behavior and velocity.

All Beenz transactions were processed on our own servers using proprietary technology and software applications. Participating distributors only needed to add a few lines of code to their web pages to join our network. Our back-end dashboard offered merchants real-time reporting on their Beenz transactions, as well as aggregated demographic data on their customers. This gave businesses a powerful tool to understand consumer behaviour and make informed decisions. We also introduced automated "software wizards"—interactive assistants that guided merchants through the process of configuring their own promotional offers. This allowed merchants to easily tailor Beenz-based incentives to engage and retain their customers.

By July 2000, Beenz had established a strong and diverse user base. The largest age group worldwide was 19 to 24, followed closely by 25 to 30, demonstrating its appeal among young, tech-savvy consumers. The gender split was nearly equal, with 52% male and 48% female, reflecting Beenz’s broad market appeal.

Preparing to IPO: Beenz’ Explosive Expansion and the Storm Ahead

Beenz was expanding at an unprecedented pace. As Global CMO, I was constantly flying between Europe, Asia, and the Americas, establishing and overseeing our growing network of offices and teams worldwide. Our expansion was so rapid that we had to appoint Vice Presidents for the Americas, Asia-Pacific, and Europe to manage our extensive global footprint. Beenz had become a global player, operating in Europe, Asia and North America with over 265 employees. With 2.3 billion Beenz in circulation and 4 million registered customers, we were handling millions of weekly transactions. The sheer scale of our operations was impressive, and investment bankers were lining up to prepare us for an IPO, with some valuations surpassing the unicorn threshold. But behind all the glitz and success there were serious problems inside the business.

Toxic Leadership and Weak Corporate Governance Led to Beenz’s Demise

At Beenz, we faced the typical challenges of scaling a business globally, but its downfall was ultimately driven by a toxic, ego-driven leadership culture, poor transparency, and weak governance. Our governance was dominated by the closed-door, venture capital and private equity-driven culture of the New York-based board, leading to a flawed and isolated decision-making process. We were a company of entrepreneurs, but we had lost control to the financial backers.

Along with several other C-suite executives, I repeatedly warned the board about the toxic leadership culture that was eroding morale and threatening the company’s future. Our concerns were constantly dismissed. Despite our rapid expansion, no one on the board seemed alarmed by our escalating global cash burn—millions of dollars per month—until it was too late, despite repeated warnings from the C-suite. While the Beenz economy was thriving, we had yet to establish a sustainable revenue model.

As a senior leader, I had a responsibility to both our investors and employees to ensure the company's survival. In a unanimous stand, my C-suite colleagues and I jointly signed a letter demanding immediate leadership changes, making it clear that we would resign ‘en masse’ if no corrective action was taken.

Under such immense pressure, the board made adjustments—but by then, the company had drifted too far from its original vision of building a universal web currency and was running out of cash. Key executives were sidelined or removed. We had lost control of what we had worked so hard to create.

This fundamental failure of strategy and governance ultimately led to my departure. By September 2000, I had left Beenz to launch another tech venture.

The Dot-Com Bubble Bursts: A $100 Million Burn and the Final Collapse

Beenz had been riding the dot-com bubble that lasted between 1998 and 2000. When the bubble burst in late 1999, the Nasdaq Composite Index plummeted by 78%, wiping out $5 trillion in investor losses. This market collapse, combined with our internal leadership and governance failures, accelerated Beenz’s decline. Beenz valuation had plummeted and was running out of cash. It had burned through almost $100 million due to weak strategic alignment, and inadequate financial controls. In the end, the remaining board members—some of whom had other investments to consider—chose to dismantle Beenz.com as quickly as possible rather than face the stigma and humiliation of bankruptcy.

By 2001, The Register reported:

"After giving effect to the cost of discontinuing the majority of its global operations, the company has reduced its ongoing monthly burn rate in excess of 90% from its peak in 2000. As of the date of this letter, beenz.com has reduced its headcount from in excess of 265 at its peak during 2000, to just 30 employees as of April 2001."

The groundbreaking global currency brand I had created—and that many investors had backed—was ultimately derailed by toxic leadership, weak governance, and poor strategic oversight. Just months later, Beenz was sold to Carlson Marketing Group, a U.S. customer loyalty services company, in a last-ditch effort to avoid public failure, causing my vision of building a multibillion-dollar digital currency brand—the

de-facto currency of the web—to be lost.

Moving On, Yahoo Calls and Founding Opodo.com

In 2000, following a brief sabbatical, I was approached by Yahoo to become their Chief Marketing Officer. The company had recently gone public, achieving the third-largest first-day gains of any IPO on record. Yahoo was impressed with my work at Beenz—after all, if you can create a global digital currency brand in just two years, nothing is impossible to you. I flew to San Francisco to meet with the Yahoo founders and executive team to discuss the opportunity.

At the same time, my client, British Airways, approached me to explore the possibility of launching a new European startup to disrupt online travel in partnership with them and eight other major airlines. While joining Yahoo would have meant becoming part of a large public company with its inherent internal politics, the prospect of creating a new independent startup was far more exciting. Ultimately, I chose to stay in Europe and co-founded Opodo.com—a disruptive travel business, co-owned with Europe’s largest airlines. Unlike Beenz, Opodo thrived, driven by a strong team, a clear strategic vision and business model, ethical governance, flawless execution, and a highly effective board.

Despite launching in the turbulent post-9/11 travel industry, Opodo rapidly scaled into a €1.2 billion revenue company, successfully competing against established industry giants like Expedia and Thomas Cook. The key lesson? Good, transparent governance isn’t just essential for large corporations—it’s vital for start-ups, too. And, of course, genius branding and marketing make all the difference!

The Future of Money and Crypto: The Revolution We Started Continues

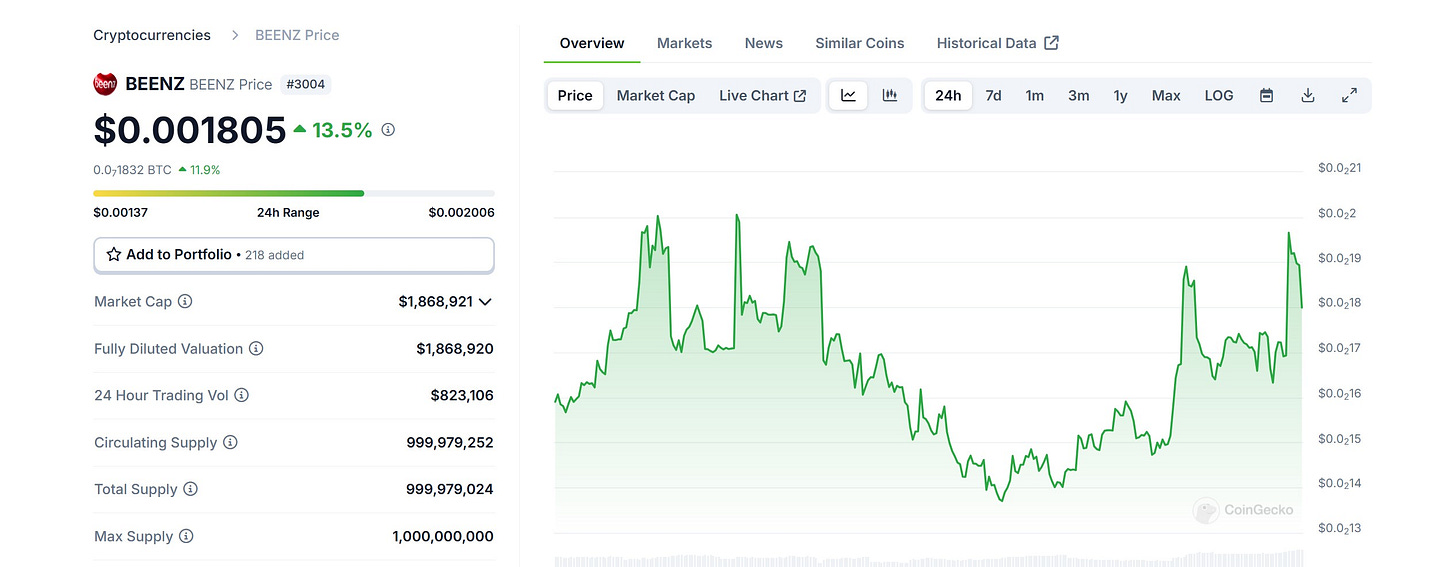

In many ways, Beenz was a glimpse into the future—a vision of what digital money could be. The future of digital currencies will depend on how well we balance innovation with usability, regulation with freedom, and speculation with practical application. The crypto world is still young, and as pioneers, we must continue to push the boundaries of what is technologically possible, just as we did with Beenz over two decades ago. Interestingly, Beenz has found new life as a MemeCoin, now boasting a total supply of 1 billion tokens in circulation, and joining the ranks of other popular coins like Dogecoin, Shiba Inu, and TrumpCoin.

Looking back on the Beenz journey, I recognise it as a pivotal moment in the evolution of digital currencies. Although Beenz.com did not ultimately endure, its foundational concepts continue to resonate in today’s crypto world. We were among the pioneers in challenging conventional notions of money, advocating for a digital-first economy—ideas that have since become central to blockchain innovation.

About the Author

Nicolas De Santis Cuadra is the Founder and Chief Disruption Officer of MEGAVISIONARY LABS, the global leader in Enterprise Visioneering®, and the President of Gold Mercury International, the global governance think tank and home of the Gold Mercury Award for Visionary Governance®, established in 1961.

Nicolas De Santis Cuadra - Personal Website